Minimum Amt

Monthly SIP Amt

Risk

High

Product Type

Type of Securities

Benchmark

Period

Market Cap

Fees

2.5% p.a. of your Investment Value + GST.

Product Type

Actively Managed Advisory Product

Benchmark

Market Cap

MultiCap

Type of Securities

Equity

Period

Fees

2.5% p.a. of your Investment Value + GST.

WHAT IS ALPHA

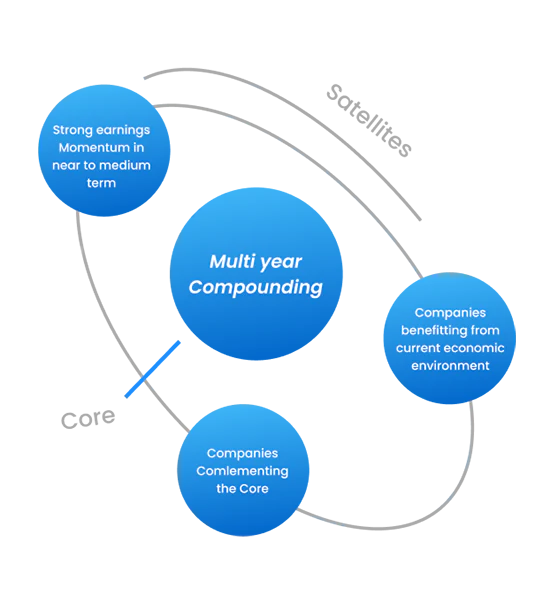

CORE & SATELLITE

Gain from short-term and long-term opportunities with this single strategy that perfectly balances both. Core portfolio supports wealth building by focusing on high-quality businesses for long term and Satellite portfolio attempts to discover earnings and rebalancing with businesses that gain from changing economic cycles. Own companies which are amongst leaders in their industry which can generate superior ROCE and cyclical businesses which would benefit from current economic cycle.

KEY FEATURES

INVESTMENT UNIVERSE,

PROCESS & STRATEGY

- Defined investment universe to include companies with good quality businesses, strong track record and corporate governance

- Confluence of Sector/Company research; Regular expert/ management interaction

- Portfolio Construction based on best ideas on bottoms up basis

- Zero tolerance to minimize Price/Volatility/Liquidity & Quality risk

investment universe process & strategy

Idea Generation

Our Investment Team’s Analysts conduct quantitative and qualitative research on businesses in the investable universe to find promising enterprises. This study include going through company filings and transcripts, networking with industry participants, filtering by financial indicators that we believe are leading predictors of business quality, and much more.

Fundamental Analysis

After identifying a potential company, the Investment Team performs bottom-up fundamental analysis to see if the business has enduring competitive advantages, promising future growth and unit economics, and sound management. This procedure entails reviewing the company filings from the previous few years, the earnings transcripts, the management presentations, and sell-side research to comprehend how the business and its sector function.

Valuation

The Investment Team evaluates the company’s absolute and relative valuation in comparison to their assessment of its long-term intrinsic value after validating the company’s competitive advantages, growth prospects, and management quality.

Portfolio Monitoring